from abc import ABC, abstractmethod

import matplotlib.pylab as plt

from matplotlib import cm

from mpl_toolkits.mplot3d import Axes3D

import numpy as np

import pandas as pd

import torch

from torch import nn

from scipy.stats import norm

import seaborn as sns

dtype = torch.float32

normal_dist = torch.distributions.Normal(0.0, 1.0)

Model classes.

class Model(ABC):

def __init__(self):

pass

@abstractmethod

def compute_discount_factor(self, t, T):

pass

@abstractmethod

def generate_paths(self, required_schedule, num_paths, dt):

pass

@staticmethod

def generate_schedule(times, dt):

assert len(times) > 0

times = sorted(times)

t_0 = 0.0

schedule = [t_0]

for t in times:

if abs(t - t_0) < 1e-10:

t_0 = t

continue

n = int(np.ceil((t - t_0) / dt)) + 1

schedule += np.linspace(t_0, t, n).tolist()[1:]

t_0 = t

return torch.tensor(list(map(lambda x: round(x, 9), schedule)))

class BlackScholesModel(Model):

def __init__(self, S_0: float, r: float, q: float, σ: float):

self.S_0 = torch.tensor(S_0)

self.r = torch.tensor(r)

self.q = torch.tensor(q)

self.σ = torch.tensor(σ)

def compute_discount_factor(self, t, T):

return np.exp(-self.r * (T - t))

def generate_paths(self, required_schedule, num_paths, dt):

schedule = self.generate_schedule(required_schedule, dt)

self.N = len(schedule)

S_0, r, q, σ = self.S_0, self.r, self.q, self.σ

retval = [torch.full((num_paths,), S_0)]

X = retval[0].log()

W = torch.randn(self.N, num_paths)

t = 0.0

for i in range(0, self.N - 1):

dt = schedule[i + 1] - schedule[i]

t += dt

sqrt_dt = dt.sqrt()

X = X + (r - q - 0.5 * σ**2) * dt + σ * sqrt_dt * W[i, :]

retval.append(X.exp())

return schedule, torch.vstack(retval)

Market classes to buy and sell stock.

class Market(ABC):

@abstractmethod

def cash_flow_shares(self, t, S_t, shares):

"""Buy if positive and sell if negative; result is a negative cash flow for

the former case and a negative cash flow for the latter."""

pass

@abstractmethod

def buy_shares(self, t, S_t, shares):

"Amount of money requires for buying the specified amount of shares."

pass

@abstractmethod

def sell_shares(self, t, S_t, shares):

pass

class NoTransactionCostMarket(Market):

def cash_flow_shares(self, t, S_t, shares):

return -S_t * shares

def buy_shares(self, t, S_t, shares):

assert sum(torch.where(shares < 0.0, torch.tensor(1.0), torch.tensor(0.0))) == 0.0

return S_t * shares

def sell_shares(self, t, S_t, shares):

assert sum(torch.where(shares < 0.0, torch.tensor(1.0), torch.tensor(0.0))) == 0.0

return S_t * shares

class RelativeTransactionCostMarket(Market):

def __init__(self, fraction):

self.fraction = fraction

def cash_flow_shares(self, t, S_t, shares):

multiplier = torch.where(shares > 0, 1 + self.fraction, 1 - self.fraction)

return -multiplier * S_t * shares

def buy_shares(self, t, S_t, shares):

assert sum(torch.where(shares < 0.0, torch.tensor(1.0), torch.tensor(0.0))) == 0.0

return (1 + self.fraction) * S_t * shares

def sell_shares(self, t, S_t, shares):

assert sum(torch.where(shares < 0.0, torch.tensor(1.0), torch.tensor(0.0))) == 0.0

return (1 - self.fraction) * S_t * shares

Contract classes.

class Contract(ABC):

def __init__(self):

pass

@abstractmethod

def description(self):

pass

@abstractmethod

def initialize(self, t, S_t):

pass

@abstractmethod

def advance(self, t, S_t):

pass

@abstractmethod

def execute(self, t, S_t, cash, shares, market: Market):

pass

@abstractmethod

def finalize(self):

pass

@abstractmethod

def black_scholes_price(self, t, S_t, model: BlackScholesModel):

pass

@abstractmethod

def black_scholes_delta(self, t, S_t, model: BlackScholesModel):

pass

@abstractmethod

def required_schedule(self):

pass

@abstractmethod

def monte_carlo_payoffs(self, model: Model, schedule, paths):

pass

@abstractmethod

def num_features():

pass

@abstractmethod

def features(self, model: Model, t, S_t):

pass

class VanillaOption(Contract):

def __init__(self, position, notional: float, K: float, T: float, is_call: float):

assert position in ['L', 'S']

self.position = position

self.long_short = torch.tensor(1.0) if position == 'L' else torch.tensor(-1.0)

self.notional = torch.tensor(notional)

self.K = torch.tensor(K)

self.T = torch.tensor(T)

self.is_call = is_call

def description(self):

long_short = 'long' if self.position == 'L' else 'short'

call_put = 'call' if self.is_call else 'put'

return f'Vanilla {call_put}, {long_short}, K={self.K.item():.4f}, T={self.T.item():.4f}'

def initialize(self, t, S_t):

return torch.zeros_like(S_t), torch.zeros_like(S_t)

def advance(self, t, S_t):

pass

def execute(self, t, S_t, cash, shares, market: Market):

if t != self.T:

# nothing to do before expiry

return cash, shares

if self.position == 'L':

return self._execute_long(t, S_t, cash, shares, market)

else:

return self._execute_short(t, S_t, cash, shares, market)

def finalize(self):

pass

def black_scholes_price(self, t, S_t, model: BlackScholesModel):

notional, T, K = self.notional, self.T, self.K

assert t <= T

r, q, σ = model.r, model.q, model.σ

τ = T - t

F_t = S_t * torch.exp((r - q) * τ)

df = torch.exp(-r * τ)

ω = 1.0 if self.is_call else -1.0

if τ == 0:

return notional * torch.maximum(ω * (S_t - K), torch.tensor(0.0))

d_plus = (torch.log(F_t / K) + 0.5 * σ**2 * τ) / σ / torch.sqrt(τ)

d_minus = d_plus - σ * torch.sqrt(τ)

return self.long_short * notional * ω * df * (F_t * normal_dist.cdf(ω * d_plus) - K * normal_dist.cdf(ω * d_minus))

def black_scholes_delta(self, t, S_t, model: BlackScholesModel):

notional, T, K = self.notional, self.T, self.K

assert t <= T

r, q, σ = model.r, model.q, model.σ

τ = T - t

F_t = S_t * torch.exp((r - q) * τ)

ω = 1.0 if self.is_call else -1.0

if τ == 0:

if self.is_call:

return self.long_short * torch.where(S_t > K, notional, torch.tensor(0.0))

else:

return self.long_short * torch.where(S_t < K, -notional, torch.tensor(0.0))

d_plus = (torch.log(F_t / K) + 0.5 * σ**2 * τ) / σ / torch.sqrt(τ)

return self.long_short * notional * ω * torch.exp(-q * τ) * normal_dist.cdf(ω * d_plus)

def required_schedule(self):

return [self.T]

def monte_carlo_payoffs(self, model, schedule, paths):

S_T = paths[-1]

ω = 1.0 if self.is_call else -1.0

scaling = model.compute_discount_factor(0.0, self.T)

return scaling * self.long_short * self.notional * torch.maximum(ω * (S_T - self.K), torch.tensor(0.0))

def _execute_long(self, t, S_t, cash, shares, market):

if self.is_call:

# the client sell shares if in the money

itm = S_t > self.K

delta_shares = torch.where(itm, self.notional, torch.tensor(0.0))

delta_cash = torch.where(itm, -self.notional, torch.tensor(0.0))

else:

# the client buys shares if in the money

itm = S_t < self.K

# make sure we have the required number of shares

delta_shares = torch.clamp(self.notional - shares, torch.tensor(0.0), self.notional)

delta_shares = torch.where(itm, delta_shares, torch.tensor(0.0))

delta_cash = -market.buy_shares(t, S_t, delta_shares)

# execute transaction

delta_shares -= torch.where(itm, self.notional, torch.tensor(0.0))

delta_cash += torch.where(itm, self.K * self.notional, torch.tensor(0.0))

return cash + delta_cash, shares + delta_shares

def _execute_short(self, t, S_t, cash, shares, market):

if self.is_call:

# the client buys shares if in the money

itm = S_t > self.K

# make sure we have the required number of shares

delta_shares = torch.clamp(self.notional - shares, torch.tensor(0.0), self.notional)

delta_shares = torch.where(itm, delta_shares, torch.tensor(0.0))

delta_cash = -market.buy_shares(t, S_t, delta_shares)

# execute transaction

delta_shares += torch.where(itm, -self.notional, torch.tensor(0.0))

delta_cash += torch.where(itm, self.K * self.notional, torch.tensor(0.0))

else:

# the client seels the shares if in the money

itm = S_t < self.K

delta_shares = torch.where(itm, self.notional, torch.tensor(0.0))

delta_cash = torch.where(itm, -self.notional * self.K, torch.tensor(0.0))

return cash + delta_cash, shares + delta_shares

def num_features(self):

return 2

def features(self, model: Model, t, S_t):

return [torch.full(S_t.shape, t).unsqueeze(-1),

(S_t / model.S_0).log().unsqueeze(-1)]

class BlackScholesAnalyticPricer:

def __init__(self, model: BlackScholesModel):

self.model = model

def price(self, contract, t, S_t):

return contract.black_scholes_price(t, S_t, self.model)

def delta(self, contract, t, S_t):

return contract.black_scholes_delta(t, S_t, self.model)

class BlackScholesMonteCarloPricer:

def __init__(self, model: BlackScholesModel):

self.model = model

def price(self, contract, schedule, paths):

payoffs = contract.monte_carlo_payoffs(self.model, schedule, paths)

return payoffs.mean(), payoffs.std() / torch.sqrt(torch.tensor(float(len(payoffs))))

market = NoTransactionCostMarket()

model = BlackScholesModel(100.0, 0.05, 0.02, 0.25)

analytic_pricer = BlackScholesAnalyticPricer(model)

mc_pricer = BlackScholesMonteCarloPricer(model)

We verify that analytic and Monte Carlo prices agree.

short_vanilla_call = VanillaOption('S', 1.0, 95.0, 0.5, True)

long_vanilla_call = VanillaOption('L', 1.0, 95.0, 0.5, True)

for contract in [short_vanilla_call, long_vanilla_call]:

print(contract.description() + ':')

torch.manual_seed(42)

contract.initialize(0.0, model.S_0)

analytic_price = analytic_pricer.price(contract, 0.0, model.S_0)

print(f"Analytic price: {analytic_price:.4f}", end='')

schedule, paths = model.generate_paths(contract.required_schedule(), 10_000, 1.0 / 52)

mc_price, mc_std = mc_pricer.price(contract, schedule, paths)

CI = (mc_price - 1.96 * mc_std, mc_price + 1.96 * mc_std)

print(f', Monte Carlo price: [{CI[0]:.4f}, {CI[1]:.4f}]', end='')

if analytic_price < CI[0] or analytic_price > CI[1]:

print(' -> *ERROR*')

else:

print(' -> OK')

print()

Vanilla call, short, K=95.0000, T=0.5000:

Analytic price: -10.3924, Monte Carlo price: [-10.6495, -10.1216] -> OK

Vanilla call, long, K=95.0000, T=0.5000:

Analytic price: 10.3924, Monte Carlo price: [10.1216, 10.6495] -> OK

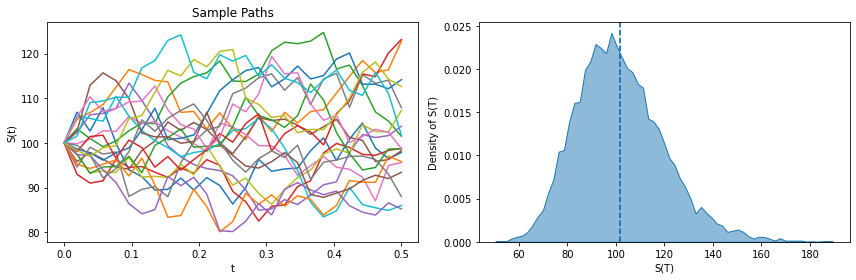

fig, (ax0, ax1) = plt.subplots(ncols=2, figsize=(12, 4))

for i in range(20):

ax0.plot(schedule, paths[:, i])

ax0.set_xlabel('t')

ax0.set_ylabel('S(t)')

ax0.set_title('Sample Paths')

sns.histplot(paths[-1], ax=ax1, element='poly', stat='density', alpha=0.5)

ax1.axvline(x=paths[-1].mean(), linestyle='dashed')

ax1.axvline(model.S_0 * torch.exp((model.r - model.q) * contract.T), linestyle='dashed')

ax1.set_xlabel('S(T)')

ax1.set_ylabel('Density of S(T)')

fig.tight_layout()

class Hedger(ABC):

@abstractmethod

def description(self):

pass

@abstractmethod

def calibrate(self, **kwargs):

pass

@abstractmethod

def hedge(self, t, S_t, shares):

pass

class BlackScholesHedger(Hedger):

def __init__(self, model: BlackScholesModel, contract: Contract):

self.contract = contract

self.pricer = BlackScholesAnalyticPricer(model)

def description(self):

return 'Black-Scholes hedger'

def calibrate(self, **kwargs):

pass

def hedge(self, t, S_t, shares):

return -self.pricer.delta(self.contract, t, S_t)

class HedgeNet(nn.Module):

def __init__(self, num_features):

super().__init__()

self.layers = nn.Sequential(

nn.Linear(num_features, 64),

nn.ReLU(),

nn.Linear(64, 32),

nn.ReLU(),

nn.Linear(32, 16),

nn.ReLU(),

nn.Linear(16, 1)

)

def forward(self, x):

return self.layers(x)

class DeepHedger(Hedger):

def __init__(self, model, contract: Contract, market, scaling_price):

self.model = model

self.contract = contract

self.market = market

self.scaling_price = scaling_price

def description(self):

return 'Deep Hedger'

def calibrate(self, **kwargs):

batch_size = kwargs['batch_size']

lr = kwargs['lr']

num_iters = kwargs['num_iters']

num_paths = kwargs['num_paths']

max_dt = kwargs['max_dt']

print_every = kwargs['print_every']

net = HedgeNet(contract.num_features())

optimizer = torch.optim.Adam(net.parameters(), lr=lr)

for i in range(num_iters):

total_loss = 0.0

schedule, paths = self.model.generate_paths(contract.required_schedule(), num_paths, max_dt)

diff_schedule = torch.from_numpy(np.diff(schedule))

batches = torch.split(paths, batch_size, dim=1)

for batch in batches:

cash, shares = contract.initialize(schedule[0], batch[0])

for t, dt, S_t in zip(schedule[:-1], diff_schedule, batch[:-1]):

contract.advance(t, S_t)

x = torch.hstack(contract.features(self.model, t, S_t))

delta = net(x).squeeze(1)

cash += market.cash_flow_shares(t, S_t, delta - shares)

shares = delta

# interest on cash

cash *= torch.exp(self.model.r * dt)

# cash coming from the dividends

cash += shares * S_t * (torch.exp(self.model.q * dt) - 1)

assert cash.shape == batch[0].shape

assert shares.shape == batch[0].shape

T, S_T = schedule[-1], batch[-1]

cash, shares = contract.execute(T, S_T, cash, shares, market)

contract.finalize()

# liquidate all remaining positions

cash += market.cash_flow_shares(T, S_T, -shares)

# discount to model date

cash *= torch.exp(-self.model.r * T)

# minimize square error

loss = cash.var() / (self.scaling_price**2)

total_loss += loss.item()

optimizer.zero_grad()

loss.backward()

optimizer.step()

total_loss /= len(batches)

if (i + 1) % print_every == 0:

print(f"Iter {i + 1:4}: loss = {total_loss:.4e}")

self.net = net

def hedge(self, t, S_t, shares):

x = torch.hstack(contract.features(self.model, t, S_t))

y = self.net(x).squeeze(1).detach()

return y

contract = VanillaOption('S', 1.0, 105.0, 0.25, True)

bs_model = BlackScholesModel(S_0=100.0, r=0.05, q=0.02, σ=0.25)

analytic_pricer = BlackScholesAnalyticPricer(bs_model)

bs_price = analytic_pricer.price(contract, 0.0, bs_model.S_0)

print(f"Black-Scholes price: {bs_price.item():.4f}")

Black-Scholes price: -3.2393

bs_hedger = BlackScholesHedger(bs_model, contract)

deep_hedger = DeepHedger(bs_model, contract, NoTransactionCostMarket(), bs_price)

torch.manual_seed(42)

deep_hedger.calibrate(batch_size=32, lr=0.5e-3, num_iters=100, num_paths=1_000, max_dt=1 / 256,

scaling_price=bs_price, print_every=10)

Iter 10: loss = 1.4471e-01

Iter 20: loss = 8.1138e-02

Iter 30: loss = 6.7405e-02

Iter 40: loss = 5.0502e-02

Iter 50: loss = 5.0674e-02

Iter 60: loss = 4.0541e-02

Iter 70: loss = 3.5466e-02

Iter 80: loss = 3.6956e-02

Iter 90: loss = 3.9783e-02

Iter 100: loss = 3.3974e-02

class Agent(ABC):

@abstractmethod

def execute(self, contract: Contract, market: Market, hedger: Hedger):

pass

class BlackScholesAgent(Agent):

def __init__(self, model: BlackScholesModel, frequency: float, num_paths: int):

self.model = model

self.frequency = frequency

self.num_paths = num_paths

def execute(self, contract: Contract, market: Market, hedger: Hedger, seed):

torch.manual_seed(seed)

schedule, paths = self.model.generate_paths(contract.required_schedule(), self.num_paths, self.frequency)

diff_schedule = torch.from_numpy(np.diff(schedule))

cash, shares = contract.initialize(schedule[0], paths[0])

for t, dt, S_t in zip(schedule[:-1], diff_schedule, paths[:-1]):

contract.advance(t, S_t)

new_shares = hedger.hedge(t, S_t, shares)

cash += market.cash_flow_shares(t, S_t, new_shares - shares)

shares = new_shares

# interest on cash

cash *= torch.exp(self.model.r * dt)

# cash coming from the dividends

cash += shares * S_t * (torch.exp(self.model.q * dt) - 1)

assert cash.shape == paths[0].shape

assert shares.shape == paths[0].shape

T, S_T = schedule[-1], paths[-1]

cash, shares = contract.execute(T, S_T, cash, shares, market)

contract.finalize()

# liquidate all remaining positions

cash += market.cash_flow_shares(T, S_T, -shares)

# discount to model date

cash *= torch.exp(-self.model.r * T)

hedger_price = cash.mean()

hedger_std = cash.std() / np.sqrt(self.num_paths)

# for debugging

self.schedule = schedule

self.paths = paths

return hedger_price, hedger_std, cash

agent = BlackScholesAgent(model, frequency=1 / 256, num_paths=1_000)

market = NoTransactionCostMarket()

results = {}

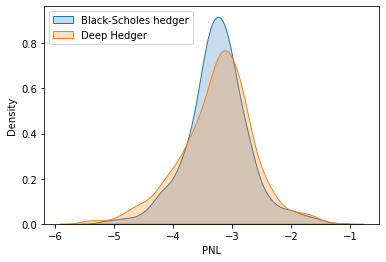

for hedger in[bs_hedger, deep_hedger]:

hedger_price, hedger_std, cash = agent.execute(contract, market, hedger, seed=42)

print(f"Hedger price = {hedger_price:.4f}, std = {hedger_std:.4f}, Black-Scholes price: {bs_price:.4f}, "\

f"diff = {hedger_price - bs_price:.4f}")

print(f"Hedger std dev / price = {cash.std() / bs_price:.4f}")

results[hedger.description()] = cash

Hedger price = -3.2524, std = 0.0169, Black-Scholes price: -3.2393, diff = -0.0131

Hedger std dev / price = -0.1647

Hedger price = -3.2620, std = 0.0197, Black-Scholes price: -3.2393, diff = -0.0226

Hedger std dev / price = -0.1927

for k, v in results.items():

sns.kdeplot(v, label=k, shade=True)

plt.legend(loc='upper left')

plt.xlabel('PNL')

plt.ylabel('Density');

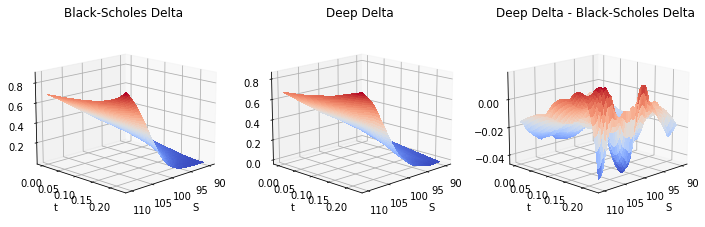

bs_deltas, deep_deltas = [], []

timegrid = torch.linspace(0.0, contract.T * 0.9, 100)

spots = torch.linspace(model.S_0 * 0.9, model.S_0 * 1.1, 100)

contract.initialize(0.0, spots)

for t in timegrid:

bs_deltas.append(bs_hedger.hedge(t, spots, 0.0).tolist())

deep_deltas.append(deep_hedger.hedge(t, spots, 0.0).tolist())

bs_deltas = np.array(bs_deltas)

deep_deltas = np.array(deep_deltas)

import matplotlib.pylab as plt

fig, (ax0, ax1, ax2) = plt.subplots(subplot_kw={'projection': '3d'}, ncols=3, figsize=(12, 4))

X, Y = np.meshgrid(spots, timegrid)

ax0.plot_surface(X, Y, bs_deltas, cmap=cm.coolwarm, linewidth=0, antialiased=False)

ax0.set_title('Black-Scholes Delta')

ax1.plot_surface(X, Y, deep_deltas, cmap=cm.coolwarm, linewidth=0, antialiased=False)

ax1.set_title('Deep Delta')

ax2.plot_surface(X, Y, deep_deltas - bs_deltas, cmap=cm.coolwarm, linewidth=0, antialiased=False)

ax2.set_title('Deep Delta - Black-Scholes Delta')

for ax in [ax0, ax1, ax2]:

ax.set_xlabel('S')

ax.set_ylabel('t')

ax.view_init(15, 45)