The Heston model is given by the following equations in a risk-neutral measure

\[\begin{aligned} \frac{dS(t)}{S(t)} & =\mu dt + \sqrt{V(t)} dW_S(t) \\ dV(t) & = \kappa(\theta−V(t)) dt + \zeta \sqrt{V(t)} dW_V(t) \\ < dW_S(t), dW_V(t)> & =ρdt, \end{aligned}\]with $\mu = r - q$.

It is easy to see that the process for the inverted spot $U(t) = S(t)^{-1}$ is still described by the Heston model. Using Itô’s lemma on $U(t) = f(S(t))$, with

\[\begin{aligned} f(s) & = \frac{1}{s} \\ % f'(s) & = -\frac{1}{s^2} \\ % f''(s) & = \frac{2}{s^3}, \\ \end{aligned}\]gives

\[dU(t) = \left( -\mu S(t) \frac{1}{S(t)^2} + \frac{1}{2} V(t) S(t)^2 \frac{2}{S(t)^3} \right)dt - \sqrt{V(t)}S(t)\frac{1}{S(t)^2} dW_S(t)\]and therefore

\[\frac{dU(t)}{U(t)} = \left( -\mu + V(t) \right) dt - \sqrt{V(t)}dW_S(t).\]We can change the measure by using

\[dW_U(t) = -dW_S(t) + \sqrt{V(t)} dt\]such that the appropriately discounted spot process becomes a martingale. We still need to adjust the second process as $dW_S(t)$ and $dW_V(t)$ are correlated. To do that, we first use

\[dW_V(t) = \rho dW_S(t) + \sqrt{1 - \rho^2} dW_V^\perp(t),\]where $dW_S(t)$ and $dW_V^\perp(t)$ are independent, then use our definition of $dW_U(t)$ above to obtain

\[dW_V(t) = - \rho dW_U(t) + \rho\sqrt{V(t)}dt + \sqrt{1 - \rho^2} dW_V^\perp(t)\]such that

\[\begin{aligned} dV(t) & = \kappa(\theta - V(t))dt + \zeta \sqrt{V(t)} dW_V(t) \\ % & = \kappa(\theta - V(t))dt + \zeta \sqrt{V(t)} \left( -\rho dW_U(t) + \rho \sqrt{V(t)} dt + \sqrt{1 - \rho^2} dW_V^\perp(t) \right) \\ % & = \kappa \theta dt - \kappa V(t) dt + \zeta \rho V(t) dt + \zeta \sqrt{V(t)}\left( -\rho dW_U(t) + \sqrt{1 - \rho^2} dW_V^\perp(t) \right) \\ % & = \left( \kappa \theta - (\kappa - \zeta \rho) V(t) \right) dt + \zeta \sqrt{V(t)} dW_{\bar{V}}(t) \\ % & = (\kappa \theta - \bar\kappa V(t)) dt + \zeta \sqrt{V(t)} dW_{\bar{V}}(t) \\ % & = \bar\kappa \left( \frac{\kappa}{\bar\kappa}\theta - V(t) \right) dt + \zeta \sqrt{V(t)} dW_{\bar{V}}(t) \\ % & = \bar\kappa(\bar\theta - V(t)) dt + \zeta \sqrt{V(t)} dW_{\bar{V}}(t), \end{aligned}\]with

\[\begin{aligned} <dW_U(t), dW_{\bar{V}}(t)> & = -\rho dt \\ % \bar\kappa & = \kappa - \zeta \rho \\ % \bar\theta & = \frac{\kappa}{\bar \kappa} \theta. \end{aligned}\]Clearly, if $\rho = 0$, we just have $\bar\kappa = \kappa$, $\bar\theta = \theta$, meaning that in this case the $V(t)$ process is unchanged.

from dataclasses import dataclass

import matplotlib.colors as mcolors

import matplotlib.pylab as plt

from mpl_toolkits.mplot3d.axes3d import Axes3D

import numpy as np

import scipy.integrate

from scipy.optimize import root_scalar

from scipy.stats import norm

Φ = norm.cdf

The Contract class wraps the basic ingredients of a vanilla contract – the maturity T, the strike K, and a boolean flag to indicate whether it is a call or a put.

@dataclass

class Contract:

K: float

T: float

is_call: bool

The Model class defines a Heston model and provides the methods to price a vanilla contract with the closed-form approximation and Monte Carlo. The closed-form approximation requires the numerical integration of an indefinite integral, done using scipy.integrate.quad_vec, while for Monte Carlo pricing we first generate a number of paths with the Heston dynamics and then evaluate in expectation the value of the vanilla payoff at expiry (which is then discounted to time 0).

@dataclass

class Model:

S_0: float

r: float

q: float

V_0: float

κ: float

θ: float

ζ: float

ρ: float

def __str__(self):

return f'S_0={self.S_0}, V_0={self.V_0}, κ={self.κ}, θ={self.θ}, ζ={self.ζ}, ρ={self.ρ}'

def phi(self, u, tau):

alpha_hat = -0.5 * u * (u + 1j)

beta = self.κ - 1j * u * self.ζ * self.ρ

gamma = 0.5 * self.ζ ** 2

d = np.sqrt(beta**2 - 4 * alpha_hat * gamma)

g = (beta - d) / (beta + d)

h = np.exp(-d*tau)

A_ = (beta-d)*tau - 2*np.log((g*h-1) / (g-1))

A = self.κ * self.θ / (self.ζ**2) * A_

B = (beta - d) / (self.ζ**2) * (1 - h) / (1 - g*h)

return np.exp(A + B * self.V_0)

def integral(self, K, T):

integrand = (lambda u:

np.real(np.exp((1j*u + 0.5)*K)*self.phi(u - 0.5j, T))/(u**2 + 0.25))

i, _ = scipy.integrate.quad_vec(integrand, 0, np.inf)

return i

def compute_forward(self, T):

return self.S_0 * np.exp((self.r - self.q) * T)

def compute_price(self, contract: Contract):

K, T = contract.K, contract.T

a = np.log(self.S_0 / K) + (self.r-self.q) * T

i = self.integral(a, T)

call_price = self.S_0 * np.exp(-self.q * T) - K * np.exp(-self.r * T) / np.pi*i

if contract.is_call:

return call_price

else:

F = np.exp((self.r - self.q) * T) * self.S_0

return call_price - np.exp(-self.r * T) * (F - K)

def generate_paths(self, schedule, num_paths):

num_steps = len(schedule) - 1

S_all, V_all = [np.ones((num_paths,)) * self.S_0], [np.ones((num_paths,)) * self.V_0]

X = np.log(S_all[0])

V = V_all[0]

W_X = np.random.randn(num_steps, num_paths)

W_V_ortho = np.random.randn(num_steps, num_paths)

W_V = self.ρ * W_X + np.sqrt(1 - self.ρ**2) * W_V_ortho

for i in range(num_steps):

Δt = schedule[i + 1] - schedule[i]

sqrt_Δt = np.sqrt(Δt)

X = X + (self.r - self.q - 0.5 * V) * Δt + np.sqrt(V) * sqrt_Δt * W_X[i]

V = V + self.κ * (self.θ - V) * Δt + self.ζ * np.sqrt(V) * sqrt_Δt * W_V[i]

V = np.maximum(V, 0)

S_all.append(np.exp(X))

V_all.append(V)

return np.vstack(S_all), np.vstack(V_all)

def compute_mc_price(self, S_T, contract: Contract):

df = np.exp(-self.r * contract.T)

ω = 1.0 if contract.is_call else -1.0

Π = df * np.maximum(ω * (S_T - contract.K), 0)

mc_price, mc_std = Π.mean(), Π.std() / np.sqrt(len(S_T))

return mc_price, mc_std

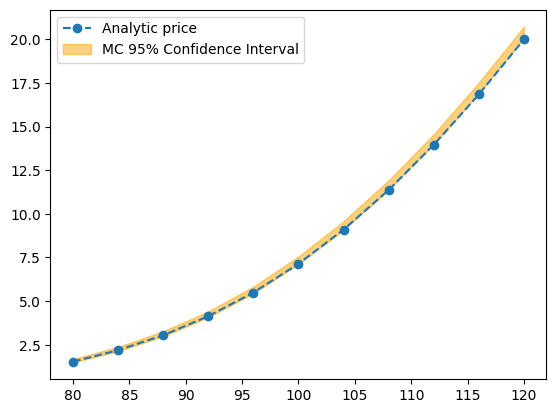

We compare the closed-form prices with the ones given by the Monte Carlo method as a check.

model = Model(S_0=100.0, r=0.02, q=0.01, V_0=0.04, κ=1.0, θ=0.04, ζ=0.2, ρ=-0.8)

K_all = np.linspace(0.8 * model.S_0, 1.2 * model.S_0, 11)

S_all = None

analytic_prices, mc_lower_prices, mc_upper_prices = [], [], []

for K in K_all:

contract = Contract(K, 1.0, False)

if S_all is None:

S_all, _ = model.generate_paths(np.linspace(0, contract.T, 201), 10_000)

analytic_prices.append(model.compute_price(contract))

mc_price, mc_std_dev = model.compute_mc_price(S_all[-1], contract)

mc_lower_prices.append(mc_price - 1.96 * mc_std_dev)

mc_upper_prices.append(mc_price + 1.96 * mc_std_dev)

plt.plot(K_all, analytic_prices, '--o', label='Analytic price')

plt.fill_between(K_all, mc_lower_prices, mc_upper_prices, alpha=0.5, color='orange', label='MC 95% Confidence Interval')

plt.legend();

It is customary to quote vanilla prices using implied volatilities, that is the volatility that is required by the Black-Scholes formula in order to generate the same price. This means that we use closed-form approximation above to compute the Heston price, then with a root search algorithm we compute the implied volatility. The procedure is repeated over several strikes and maturities and gives rise to the so-called volatility surface.

def compute_black_scholes_price(S_0, r, q, σ, contract):

K, T, is_call = contract.K, contract.T, contract.is_call

ω = 1.0 if is_call else -1.0

if T == 0.0:

return max(ω * (S_0 - K), 0.0)

df = np.exp(-r * T)

F = S_0 * np.exp((r - q) * T)

d_plus = (np.log(F / K) + 0.5 * σ**2 * T) / σ / np.sqrt(T)

d_minus = d_plus - σ * np.sqrt(T)

return ω * df * (F * Φ(ω * d_plus) - K * Φ(ω * d_minus))

def compute_implied_vol(S_0, r, q, σ_0, contract, target_price):

def inner(σ):

return compute_black_scholes_price(S_0, r, q, σ, contract) - target_price

try:

result = root_scalar(inner, x0=σ_0, bracket=[1e-3, 0.5])

except:

return np.nan

return np.nan if not result.converged else result.root

def compute_smile(model, T, factor=3, num_points=101):

F = model.compute_forward(T)

contract = Contract(K=F, T=T, is_call=True)

price_ATM = model.compute_price(contract)

σ_ATM = compute_implied_vol(model.S_0, model.r, model.q, 0.5, contract, price_ATM)

width = factor * σ_ATM * np.sqrt(T)

σs = []

Ks = np.linspace(F * np.exp(-width), F * np.exp(width), num_points)

for K in Ks:

contract = Contract(K=K, T=T, is_call=K > F)

price = model.compute_price(contract)

σ = compute_implied_vol(model.S_0, model.r, model.q, 0.5, contract, price)

σs.append(σ)

return Ks, σs

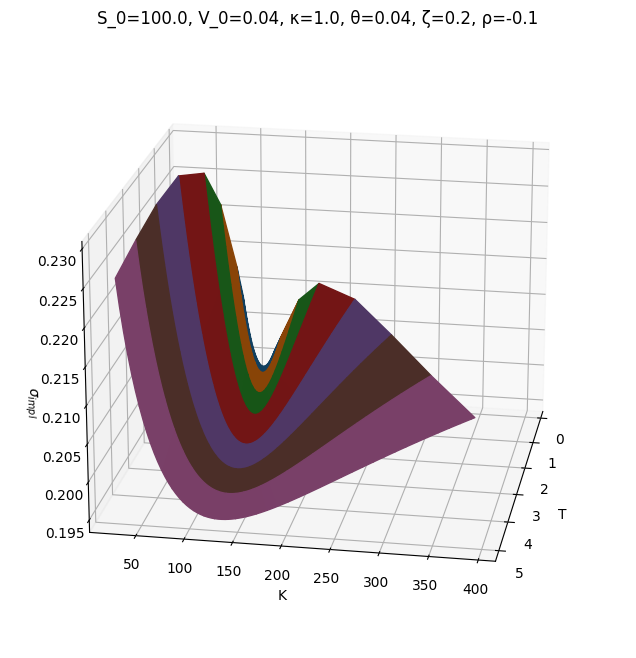

We plot the volatility surface using a 3D plot, with strikes on the X-axis, maturities on the Y-axis, and the implied volatility itself on the Z-axis.

X, Y, Z, C = [], [], [], []

colors = list(mcolors.TABLEAU_COLORS.values())

model = Model(S_0=100.0, r=0.02, q=0.01, V_0=0.04, κ=1.0, θ=0.04, ζ=0.2, ρ=-0.1)

for color, T in zip(colors, [1 / 12, 2 / 12, 6 / 12, 1, 2, 3, 4, 5]):

Ks, σs = compute_smile(model, T)

X.append([T] * len(Ks))

Y.append(Ks)

Z.append(σs)

C.append([color] * len(Ks))

fig, ax = plt.subplots(subplot_kw={'projection': '3d'}, figsize=(8, 8))

ax.plot_surface(np.array(X), np.array(Y), np.array(Z), facecolors=C)

ax.view_init(elev=20, azim=10, roll=0)

ax.set_xlabel('T')

ax.set_ylabel('K')

ax.set_zlabel('$σ_{impl}$')

ax.set_title(model);

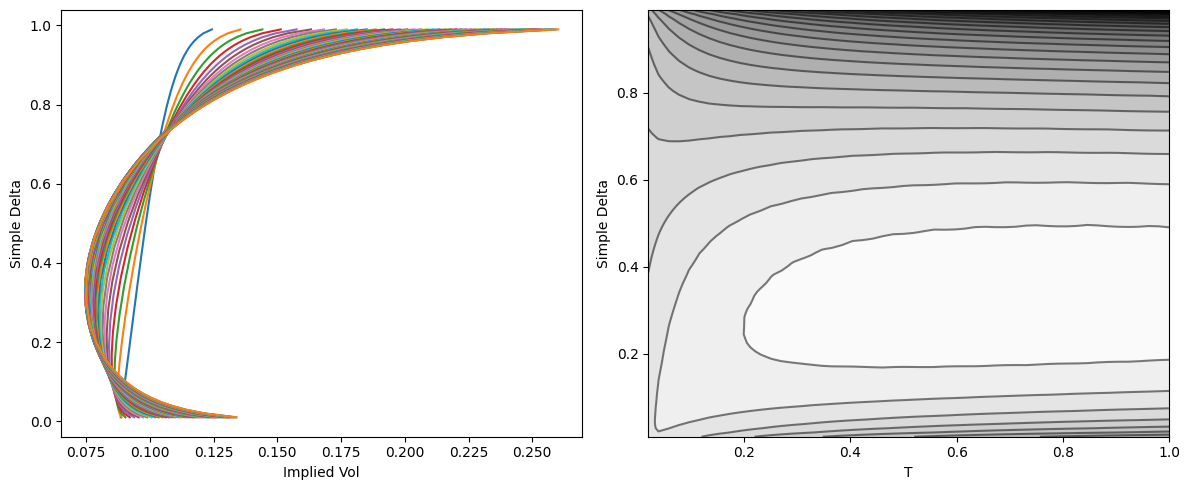

The picture above is nice yet a bit difficult to interpret, and often without convenient view angles can be confusing. A better way is to replace strikes with the so-called simple delta, defined as

\[\delta_{simple}(K, T) = \Phi\left( \frac{\log(F / K)}{\sigma \sqrt{T}} \right),\]where $\Phi$ is the cumulative density function of the normal distribution, $T$ the maturity of the option, $F$ the forward at $T$, and $K$ the strike. By definition $\delta_{simple}$ is a number between 0 and 1 for all maturities and gives a convenient way of adimensionalize the moneyness $F/K$. One such surface is computed below.

def compute_vol_on_delta_grid(T, d_grid, num_points):

F = model.compute_forward(T)

Ks, σs = compute_smile(model, T, factor=9, num_points=num_points)

ds = Φ(np.log(Ks / F) / σs / np.sqrt(T))

σs = np.interp(d_grid, ds, σs)

# remove nans at the extremes, replace them with flat interpolation

n = len(σs)

for i in range(n // 2, 0, -1):

if np.isnan(σs[i - 1]):

σs[i - 1] = σs[i]

for i in range(n // 2, n - 1):

if np.isnan(σs[i + 1]):

σs[i + 1] = σs[i]

return σs

model = Model(S_0=1.0, r=0.05, q=0.03, V_0=0.1**2, κ=0.25, θ=0.2**2, ζ=0.5, ρ=-0.5)

d_grid = np.linspace(0.01, 0.99, 101)

X, Y, Z = [], [], []

T_all = [m / 52 for m in range(1, 53)]

for T in T_all:

σs = compute_vol_on_delta_grid(T, d_grid, 101)

X.append([T] * len(σs))

Y.append(d_grid)

Z.append(σs)

fig, (ax0, ax1) = plt.subplots(figsize=(12, 5), ncols=2)

for y, z in zip(Y, Z):

ax0.plot(z, y)

ax0.set_xlabel('Implied Vol'); ax0.set_ylabel('Simple Delta')

ax1.contour(X, Y, Z, colors='k', levels=25, alpha=0.5)

ax1.contourf(X, Y, Z, cmap='binary', levels=25)

ax1.set_xlabel('T'); ax1.set_ylabel('Simple Delta')

fig.tight_layout()