In this article we briefly cover the Stochastic Alpha Beta Rho model, knows as SABR, proposed by Hagan and co-authors. This model is defined by four parameters:

- α is the instantaneous vol;

- ν is the vol of vol;

- ρ is the correlation between the Brownian motions driving the forward rate and the instantaneous vol;

- β is the CEV component for forward rate (determines shape of forward rates, leverage effect and backbone of ATM vol).

β is one of the key parameters and affect many fundamental characteristics of the model. β is the exponent for the forward rate or the CEV exponent and effects the distribution:

- β = 1 represents stochastic lognormal dynamics;

- β = 0 defines stochastic normal dynamics;

- β = ½ defines dynamics that are similar to the ones of the CIR model.

As for the CEV component, β helps capture leverage effect without changing the underlying instantaneous vol (α).

from dataclasses import dataclass, field

import matplotlib.pylab as plt

import numpy as np

from scipy.optimize import root_scalar

from scipy.stats import norm

Φ = norm.cdf

@dataclass

class Market:

r: float

q: float

S_0: float

T: float

F_0: float = field(init=False)

def __post_init__(self):

self.F_0 = self.S_0 * np.exp((self.r - self.q) * self.T)

@dataclass

class Model:

α_0: float

β: float

ρ: float

ν: float

@dataclass

class Contract:

K: float

T: float

is_call: bool

def generate_paths(F_0, model, schedule, num_paths):

N = len(schedule) - 1

α_0, β, ρ, ν = model.α_0, model.β, model.ρ, model.ν

F_all, α_all = [np.ones((num_paths,)) * F_0], [np.ones((num_paths,)) * α_0]

F_t = F_all[0]

α_t = α_all[0]

W_F = np.random.randn(N, num_paths)

W_α_ortho = np.random.randn(N, num_paths)

W_α = ρ * W_F + np.sqrt(1 - ρ**2) * W_α_ortho

t = 0.0

for i in range(N):

Δt = schedule[i + 1] - schedule[i]

t = t + Δt

sqrt_Δt = np.sqrt(Δt)

F_t = F_t + α_t * np.power(F_t, β) * sqrt_Δt * W_F[i]

F_t = np.maximum(F_t, 0.0)

α_t = α_t + ν * α_t * sqrt_Δt * W_α[i]

F_all.append(F_t)

α_all.append(α_t)

return np.vstack(F_all), np.vstack(α_all)

def compute_mc_price(F_T, market, contract):

df = np.exp(-market.r * contract.T)

ω = 1.0 if contract.is_call else -1.0

Π = df * np.maximum(ω * (F_T - contract.K), 0)

mc_price, mc_std = Π.mean(), Π.std() / np.sqrt(len(F_T))

return mc_price, mc_std

def compute_sabr_implied_vol(market, model, contract):

F_0 = market.F_0

α_0, β, ρ, ν = model.α_0, model.β, model.ρ, model.ν

K, τ = contract.K, contract.T

# strike on the forward

if abs(F_0 - K) < 1e-9:

I_1 = (1 - β**2) / 24 * 0**2 / np.power(F_0, 2 - 2 * β)

I_2 = 1 / 4 * ρ * β * ν * α_0 / np.power(F_0, 1 - β)

I_3 = (2 - 3 * ρ**2) / 24 * ν**2

σ_ATM = α_0 / np.power(F_0, 1 - β) * (1 + (I_1 + I_2 + I_3) * τ)

return σ_ATM

# all other cases

ζ = ν / α_0 * np.power(F_0 * K, (1 - β) / 2) * np.log(F_0 / K)

χ = np.log((np.sqrt(1 - 2 * ρ * ζ + ζ**2) + ζ - ρ) / (1 - ρ))

D_1 = (1 - β)**2 / 24 * (np.log(F_0 / K))**2

D_2 = (1 - β)**4 / 1920 * (np.log(F_0 / K))**4

D = np.power(F_0 * K, (1 - β) / 2) * (1 + D_1 + D_2)

N_1 = (1 - β)**2 / 24 * α_0**2 / np.power(F_0 * K, 1 - β)

N_2 = ρ * β * ν * α_0 / 4 / np.power(F_0 * K, (1 - β) / 2)

N_3 = (2 - 3 * ρ**2) / 24 * ν**2

N = α_0 * ζ / χ * (1 + (N_1 + N_2 + N_3) * τ)

σ = N / D

return σ

def compute_analytic_price(F_0, r, σ, contract):

K, T, is_call = contract.K, contract.T, contract.is_call

τ = T

ω = 1.0 if is_call else -1.0

if τ == 0.0:

return max(ω * (F_0 - K), 0.0)

df = np.exp(-r * τ)

d_plus = (np.log(F_0 / K) + 0.5 * σ**2 * τ) / σ / np.sqrt(τ)

d_minus = d_plus - σ * np.sqrt(τ)

return ω * df * (F_0 * Φ(ω * d_plus) - K * Φ(ω * d_minus))

market = Market(r=0.2, q=0.1, S_0=100.0, T=1.0)

model = Model(α_0=0.1, β=1.0, ρ=-0.5, ν=0.25)

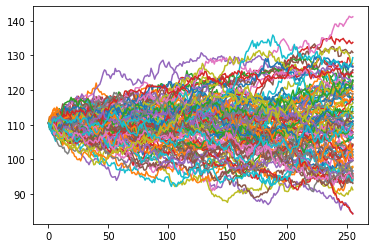

t_all = np.linspace(0, market.T, 256)

num_paths = 100_000

F_all, α_all = generate_paths(market.F_0, model, t_all, num_paths=num_paths)

for i in range(100):

plt.plot(F_all[:, i])

def compute_implied_vol(F_0, r, σ_0, contract, target_price):

def inner(σ):

return compute_analytic_price(F_0, r, σ, contract) - target_price

try:

result = root_scalar(inner, x0=σ_0, bracket=[1e-3, 0.5])

except:

return np.nan

return np.nan if not result.converged else result.root

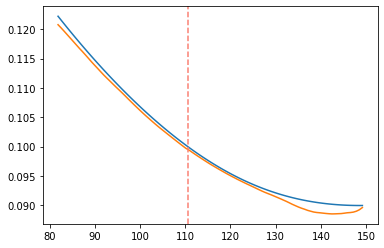

contract = Contract(K=market.F_0, T=market.T, is_call=True)

σ_ATM = compute_sabr_implied_vol(market, model, contract)

width = 3 * σ_ATM * np.sqrt(market.T)

σ_mcs, σ_models = [], []

Ks = np.linspace(market.F_0 * np.exp(-width), market.F_0 * np.exp(width), 101)

for K in Ks:

contract = Contract(K=K, T=market.T, is_call=K > market.F_0)

mc_price, mc_std = compute_mc_price(F_all[-1], market, contract)

σ_models.append(compute_sabr_implied_vol(market, model, contract))

σ_mcs.append(compute_implied_vol(market.F_0, market.r, σ_ATM, contract, mc_price))

plt.plot(Ks, σ_models)

plt.plot(Ks, σ_mcs)

plt.axvline(x=market.F_0, linestyle='dashed', color='salmon')

<matplotlib.lines.Line2D at 0x1a938d69be0>

Fitting the market data with SABR starts with a selection of β, as different β values give rise to different dynamics, while the other parameters are calibrated. Usually the calibration is a straightforward procedure as the three parameters α, ρ, and ν have different effects on the curve:

- α controls the overall height of the curve;

- ρ controls the curve’s skew;

- ν controls how much smile the curve exhibits.

Because of the widely separated roles these parameters play, the fitted parameter values tend to be very stable, even in the presence of large amounts of market noise.